BtC10: The Biggest Risks are Taken Before Anyone Thinks Capital is at Risk

In this episode of Beyond the CapEx, Cristian Gonzalez and Luis challenge one of the most common blind spots in capital projects and CapEx decision-making: the belief that capital risk starts in execution.

It doesn’t.

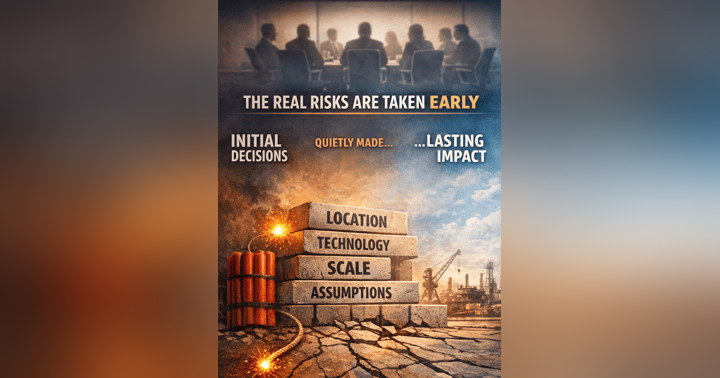

The most consequential risks are embedded early, during front-end loading (FEL), project shaping, and business case development — when spending is low, scrutiny is minimal, and leadership attention is often elsewhere. By the time a project reaches approval, most of the enterprise value, capital exposure, and optionality are already locked in.

This conversation reframes capital risk away from dashboards, controls, and execution metrics, and toward decision quality, project governance, and leadership involvement at the front end. The hosts explore why project predictability continues to elude the industry, how “small” early decisions create irreversible commitments, and why execution teams don’t create problems, they inherit them.

This episode is essential listening for CEOs, CFOs, board members, project sponsors, investors, and leaders responsible for capital allocation, industrial projects, megaprojects, and protecting enterprise value through major capital investments.

Key takeaway:

Execution doesn’t destroy value.

It delivers exactly what was shaped upstream.

⏱️ Chapters

01:30 – Why early decisions have the greatest influence

03:45 – Predictability problems: are we focusing too late?06:20 – FEL spending vs. asymmetrical risk

09:30 – Commitment risk vs. execution risk

13:00 – The “brick wall” analogy for poor front-end discipline

18:00 – Optionality and silent decisions

22:30 – Governance without bureaucracy

26:00 – Why execution only delivers what was shaped early

29:50 – Final takeaway for CEOs, CFOs, and boards

📩 ContactQuestions or topics you’d like us to cover?

Email podcast@bpmpsolutions.com

🌐 www.beyondthecapex.com 🌐 www.bpmpsolutions.com

If this episode resonated, please follow, rate, and review the show.